Currently, many of the massive used batteries — the Tesla version weighs about 900 pounds — appear to be stockpiled in hopes of greater reuse and recycling markets. But eventually those batteries, along with the toxic chemicals that can leach out of them, could end up in hazardous waste landfills.

There are no EV-battery recycling plants in California, and only five up and running nationwide, according to CalEPA. That’s despite the fact that used lithium-ion batteries contain valuable minerals that otherwise must be mined from the earth, mostly from overseas operations.

“There still aren’t enough people who understand (retired) batteries well enough to responsibly handle them,” said Zora Chung, co-founder of Signal Hill’s ReJoule Inc. “Ultimately, we need more education, and to have a more efficient marketplace to re-deploy these batteries into a second-life application.”

Chung’s EV-battery diagnostic company has launched a state-funded pilot project to adapt the used batteries for solar storage, a repurposing that could extend their lives by a decade or more — and forestall actual dismantling and recycling.

ReJoule’s nascent effort reflects a growing awareness of the battery dilemma hurtling down the pike.

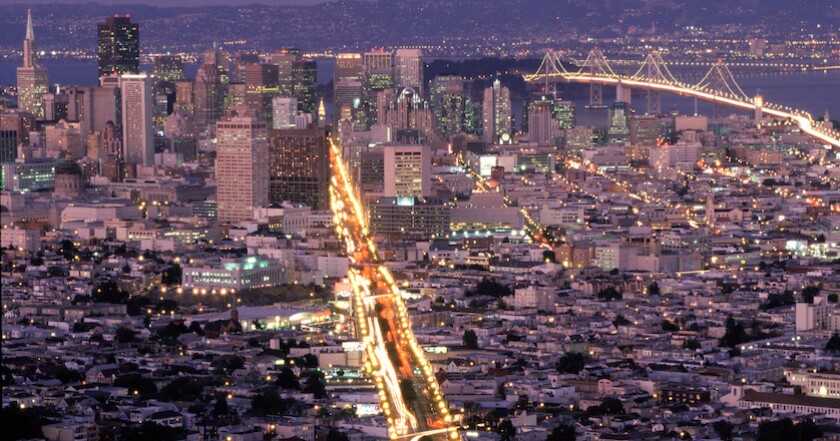

Thanks to its progressive environmental policies, California currently accounts for 42 percent of the nation’s electric vehicles. And, for several years, state legislators have recognized the potential toxic consequences posed by the battery-powered vehicles.

Assembly Bill 2832, signed into law in 2018, called for an electric vehicle advisory group to develop legislative and regulatory recommendations to ensure that “as close to 100 percent as possible of lithium-ion batteries in the state are reused or recycled at end-of-life.”

That group’s 19 members include regulators, automakers, waste and recycling interests, environmentalists, and a battery trade group. After 2 1/2 years, it completed a draft report in December and are taking public comments on the recommendations until February 16, at which point the document will be finalized and forwarded to the Legislature for action.

But some say the proposals are only a beginning, and that the broad range of interests represented on the group made it impossible to win majority approval for key items.

“The report identifies several policy solutions that have been proven to work for other products in California and for batteries in countries around the world,” said Nick Lapis, a member of the panel who represents Californians Against Waste, a nonprofit environmental research and advocacy organization.

“However, I think the policies that would actually solve the problem didn’t garner a consensus.”

Obstacle Course Ahead

The state was home to 636,000 light-duty, zero-emission vehicles by the end of 2020. The tally by the California Energy Commission includes 369,000 electric vehicles, 259,000 plug-in hybrids and 7,000 fuel cell vehicles.

While that was by far the most of any state, it was only 2.3 percent of all California’s light-duty vehicles.

That number needs to grow quickly if California is to reach its 2035 goal of 100 percent zero-emission new light-vehicle sales. (The state has set the 100 percent goal for medium- and heavy-duty trucks at 2045.)

In 2019, before the pandemic dampened new-car availability, 2 million new cars were sold in the state, according to the California New Car Dealers Association. That means 2 million or more new EVs should be hitting the road annually in 13 years, with steady growth in annual sales in the meantime.

Significant challenges remain for getting all Californians in zero-emission cars, such as creating creating electric-vehicle charging options for people who live in apartments.

But obstacles to reusing and recycling the batteries in those cars could prove even greater, in part because there hasn’t yet been much need for developing used-battery markets and regulations.

With the average car on the road for about 12 years and electric vehicles just gaining traction in the last half dozen years — Tesla’s Model X came out in 2015 — it hasn’t been an major issue. There just haven’t been that many batteries retired so far.

Those batteries that have reached the end of their lives have not been closely tracked, and it’s not clear what happens to them. One common scenario finds the aging or wrecked electric vehicle ending up at auction, where it’s purchased by a dismantler for parts.

“Those batteries may be stockpiled, awaiting better economics for recycling or resale,” said Alissa Kendall, a UC Davis engineering professor and lead author of the state’s draft report. Or perhaps they’re recycled out of state — or out of the country, she said. Or maybe they find their way into the hands of hobbyists.

“We just don’t know,” Kendall said.

The report envisions many used batteries being repurposed for electrical storage — such as storing solar energy for when the sun isn’t shining — before they’re actually taken apart and recycled. It notes ReJoule is one of four state-subsidized pilot projects to develop methods for such repurposing.

When a battery no longer provides the desired range for a car, it can have another decade of use for electrical storage, according to the report.

But sooner or later, most batteries will have to be dismantled and recycled — or disposed of as hazardous waste.

One recycling technique is a pyrometallurgical smelting process to extract valuable minerals from the battery cathode. The drawback is that it recovers only a portion of the desired materials — and none of the valuable lithium — and can result in carbon emissions.

Perhaps more promising in terms of mineral capture and environmental sensitivity is a hydrometallurgical chemical leaching process.

But while the technology is evolving to determine the best approach, a bigger hurdle may be California’s strict environmental regulations — especially because the batteries qualify as hazardous waste.

For instance, hazardous waste treatment permits take an average of two years for approval and the last new hazardous facility was approved eight years ago, according to the report. So there are no recent models for the most efficient way to negotiate a cumbersome regulatory process.

“I think (battery recycling is) a lot farther away from a policy standpoint than from a technological standpoint,” said Hanjiro Ambrose, a UC Davis researcher who was the state panel’s lead advisor.

No Quick Fixes

Beside there being no thorough process to track EV batteries, there’s no system to coordinate their collection, post-car reuse or disposal once the warranty runs out, the report says.

“Without a mechanism to collect stranded batteries, they may be unsafely accumulated, illegally abandoned, or improperly managed domestically and abroad,” it says.

A key recommendation is assigning responsibility for making sure the batteries are reused, repurposed or recycled. That responsibility would fall to the battery supplier if the battery is still under warranty, the dismantler if the car has reached its end of life, or the vehicle manufacturer if the retired car does not go to a dismantler.

A proposal to make the vehicle manufacturer responsible for most, if not all, batteries at their end of life — including covering recycling costs — didn’t muster a majority vote, although the Legislature could consider taking up such a bill.

An environmental handling fee, to be collected at the time of vehicle purchase, was also rejected.

The host of other approved recommendations include labeling the batteries so that recyclers know exactly what’s inside, providing economic incentives to recyclers, and supporting the development of domestic battery manufacturing, as most are now made overseas.

Importing the huge batteries results in a significant carbon footprint, and overseas mining for battery materials has raised both environmental and labor issues, including child labor.

But the 89-page report, dense with findings and recommendations that took 2 1/2 years to develop and will now require either new legislation or new regulations, offers no quick fixes.

Even practical and welcomed efforts already underway, such as ReJoule’s pilot project to repurpose the batteries for solar storage, are hardly having an easy go of it.

ReJoule has extensive blog postings titled, “The Obstacle Course on the Path to Repurposing Used Electric Vehicle Batteries.” While many of those obstacles are technological and logistical, co-founder Chung said the company is also preparing for a rigorous regulatory process — despite the company being considered a crucial, much-needed innovator.

“We haven’t started the permitting process yet but I’ve heard from multiple sources that can be a big hurdle,” she said.

Like a savvy investor, CalEPA spokeswoman Erin Curtis responded that with challenge comes opportunity. She pointed to the report as important groundwork for turning the approaching toxic onslaught into an environmental windfall.

“As this is an emerging industry and technology, California has an opportunity now to put policies and procedures in place at the outset that will protect public health and the environment,” Curtis said.

If things work out right, California would then be a leader not only in getting electric cars on the road, but in dealing with the massive toxic waste those vehicles will leave behind.

©2022 MediaNews Group, Inc. Distributed by Tribune Content Agency, LLC.