Austin’s transportation director, Robert Spillar, is working to prepare the city. But earlier this year, a realization hit him about what driverless cars might mean for his budget. “It struck me,” he says. “Half my revenue for transportation capacity and operations improvements is based on a parking model that may be obsolete in a dozen years.”

In the not-too-distant future, fleets of fully autonomous vehicles could be transporting riders all across Austin’s urban landscape, largely eliminating not only the need for private vehicles but also the revenue they currently bring in. Parking fees are a critical funding source for the Austin Transportation Department, accounting for nearly a quarter of its total budget. Driverless vehicles would also cut into parking tickets and traffic citations, two other significant revenue streams for Austin and many other cities. “Municipalities generate a whole lot of revenue as a byproduct of parking management and traffic enforcement,” Spillar says. “If all that suddenly disappears, we’ve got a huge financial issue to deal with.”

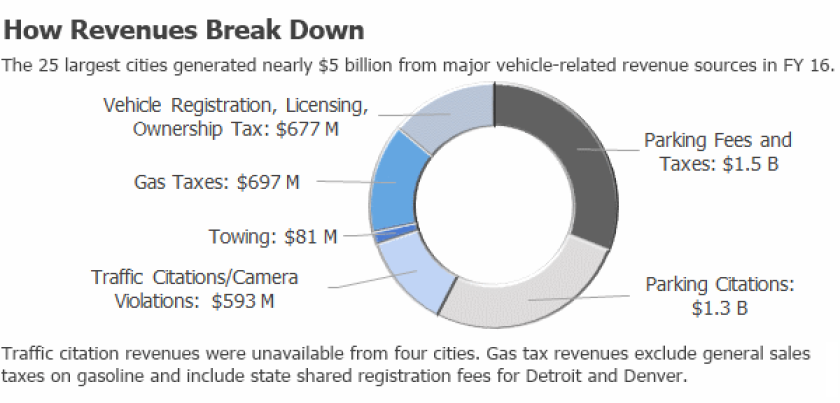

To assess how vulnerable cities’ budgets could be, Governing conducted the first national analysis of how city revenues might be affected by autonomous vehicles. For the 25 largest U.S. cities, we requested and obtained revenues for parking collections and fines, traffic citations, traffic camera fines, gas taxes, vehicle registration, licensing and select other fees. In all, these 25 cities collectively netted nearly $5 billion in auto-related revenues in fiscal 2016, or about $129 per capita. While some cities will hardly see any effect on their budgets, others could incur big fiscal consequences. For example, New York City generated $1.2 billion in 2016.

Additional sources of revenue could further decline in the long run. Because they’re electric, autonomous vehicles will further reduce general sales tax collections on gasoline. Many cities also receive revenues from taxis, car rentals and other businesses expected to undergo disruption in a driverless car era.

At the same time, there will be cost savings, such as a reduced need for traffic enforcement. It’s far too early to say exactly when and how autonomous vehicles will reshape American cities. But regardless of what unfolds, their introduction will carry numerous fiscal implications for local budgets.

High-end vehicles today already offer limited automated driving features. Market research firms expect fully autonomous vehicles that require no human intervention to be commercially available by the early part of the next decade. It’s likely to take much longer for them to proliferate to the point where parking and other public revenue streams incur major reductions. But in the long run, those hits seem inevitable.

Lois Scott, the former chief financial officer of Chicago who is studying autonomous vehicles, foresees transportation being offered as a package service in the relatively near future. People might pay hourly rates for rides. Vehicles will pick up commuters throughout the day and park themselves in remote storage facilities when not in use. Once widespread adoption occurs, Scott expects cities to lose an average of 10 to 15 percent of operating revenues. “The combination of an electric vehicle world and the sharing economy will have a powerful impact,” she says.

Estimates of just how much city revenues may eventually diminish vary considerably. Cities identified as most likely to incur the steepest revenue losses in our analysis were densely populated localities where parking comes at a premium. Those reporting the highest related revenues per capita included San Francisco ($512), Washington, D.C. ($502), and Chicago ($248). Totals were much larger in cities assessing special taxes on parking operators, deploying traffic cameras or those receiving substantial shared revenues from states in the form of gas taxes or vehicle registration fees. By comparison, any revenue reductions should hardly register in Houston, Jacksonville and some other cities. Texas’ large cities reported among the lowest per capita revenues, largely a result of the state distributing essentially no vehicle revenues.

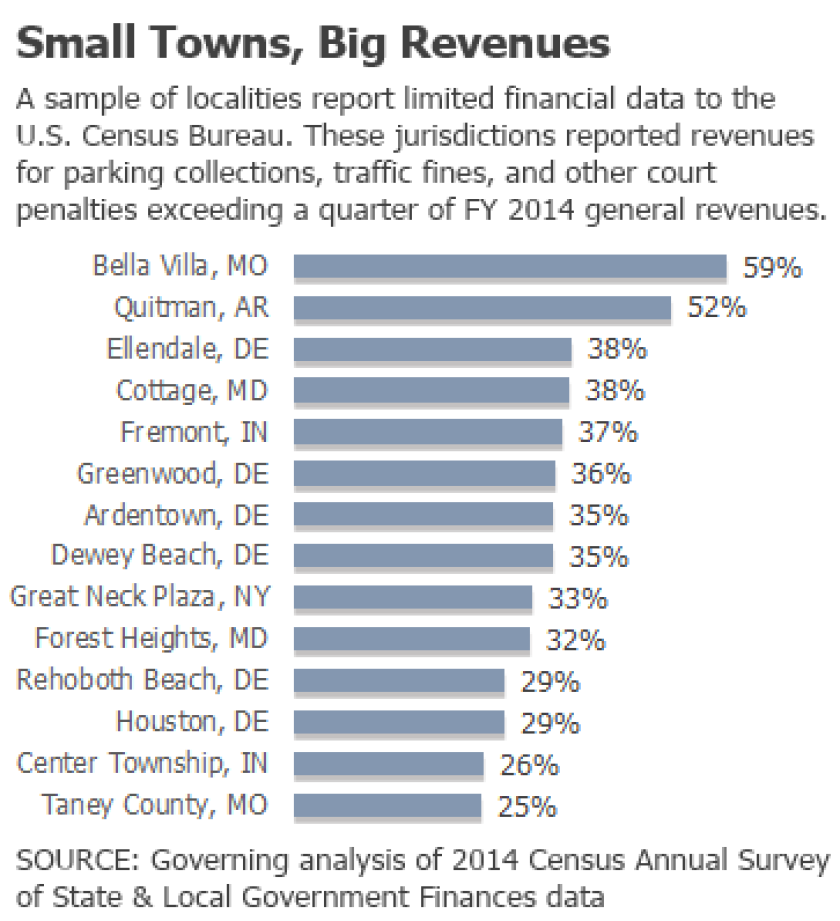

Most big cities maintain large and diverse enough revenue streams to absorb such hits to their budgets. But for some smaller jurisdictions, sizable financial shortfalls may lie ahead. In addition to the data from big cities, Governing analyzed a more limited set of fiscal year 2014 financial numbers reported to the Census Bureau by a national sample of counties, townships and villages. In 74 mostly smaller jurisdictions, parking revenues and all types of legal fines, court fees and forfeiture of deposits totaled more than 10 percent of general revenues.

Localities most reliant on parking revenues tend to be resort towns. This is particularly apparent in Delaware’s coastal communities. In Rehoboth Beach, parking-related revenues account for 30 percent of the current budget. That makes sense given that most streets throughout the city are metered, and spots fill up quickly during the summer months. “[Autonomous vehicles] could have a huge impact on the city’s budget and the services we provide,” says Krys Johnson, the city’s director of communications.

For several large cities, gasoline taxes account for the single largest source of revenue. Chicago and Columbus, Ohio, generate significant funds from locally administered gas taxes. Meanwhile, most other cities receive state-levied fuel taxes, plus general sales taxes on purchases. Phoenix, for instance, received $116.7 million in gas taxes last year.

It’s assumed that autonomous vehicles won’t be speeding or running red lights, another source of revenue for cities. On average, the largest cities took in $8.5 million in traffic citation payments. But generally, traffic tickets aren’t significant revenue generators, and savings from reduced enforcement and administration costs should offset much of the loss. Most jurisdictions aren’t making huge sums of money on speeding and red light cameras, either. Still, Chicago, New York and the District of Columbia all reported camera revenues around or exceeding $100 million.

Numerous tiny rural and suburban jurisdictions scattered across the country, however, still rely heavily on traffic citations to fund government. Some are notorious speed traps. This has surfaced as an issue in Missouri, where lawmakers have passed a bill limiting localities’ fines and court charges to 20 percent of general operating revenue.

Some independent government agencies and special purpose municipal entities will be especially liable to major revenue hits. Convention centers and airports generate much of their revenue from parking. The Phoenix Aviation Department, for instance, reported $75 million in public parking revenues last year. Parking-related income is often routed to cities’ general funds. But some transportation departments and other agencies with budgets directly tied to these revenues will be much more vulnerable financially.

The Ann Arbor, Mich., Downtown Development Authority, in addition to supporting improvement projects and programs, manages several parking lots and garages that provide about three-quarters of its annual revenue. Susan Pollay, the authority’s director, says she’s already seeing a shift away from car commuting. Bike-sharing and car-sharing services are gaining in popularity, and more young people are choosing not to get driver’s licenses. “It’s not going to be a switch flipped in five years,” she says. “We’re starting to experience it today.” Pollay is made aware of the potential effects on her budget every time she sees autonomous vehicles from the University of Michigan’s nearby testing facility cruising city streets.

Still, Ann Arbor’s growth has pushed its parking system to peak capacity during the daytime. That’s led some residents and local officials to call for the construction of a new public garage. Others want to hold off, given the disruption that’s set to take place with autonomous vehicles and on-demand ride-hailing. “It could turn out 100 different ways,” Pollay says. “We have to design and plan flexibly.”

Parking tickets are a major source of revenue in many communities. But with automated cars, that and other traffic-related revenues could disappear. (Shutterstock)

Just how much autonomous vehicles alter budgets will depend largely on how they’re adopted. A future in which low-cost shared autonomous vehicle services transport multiple passengers might lead many people to decide to go car-free, resulting in lower parking revenues, driver’s license fees and other costs tied to owning a car. Alternatively, if private autonomous vehicles emerge as the predominant mode of transportation, a larger share of the population might be willing to accept longer commutes or travel more often. This could add to cities’ congestion woes and likely drive up infrastructure costs. Ashley Hand of the consulting firm CityFi says she expects a hybrid of the two scenarios: Some will own private autonomous vehicles, while numerous other households will opt to go car-free to save money.

The way the technology evolves will hold major fiscal consequences for public transportation agencies. Driverless cars could help solve the “last mile” problem of better connecting people in less populated areas to transit hubs. They could also cut labor costs, which comprise about three-quarters of bus operating expenses for the nation’s largest transit systems.

But there’s concern that some riders might simply forgo transit altogether, says Jennifer Bradley, who heads the Aspen Institute’s Center for Urban Innovation. In New York City, a recent study by transit consultant Bruce Schaller found ridership for app-based ride services tripled between the spring of 2015 and last fall, while bus ridership declined and subway ridership dropped for the first time in years. If ride-hailing and ride-sharing companies don’t have to pay drivers, they could potentially offer transportation at a price so low that people will chose to travel by car all the way to their destinations, draining transit ridership revenues.

Gasoline tax revenues may be first to shrink as vehicles shift to electric drivetrains. Volvo recently announced that, by 2019, all its new models will be electrics or hybrids. In 2015, state-levied motor fuel taxes amounted to $11 billion in transfers to local government or direct spending on local infrastructure. Another $5.2 billion went to transit, according to Federal Highway Administration data.

Later on, if the costs of commuting by ride-sharing come down and more people opt out of vehicle ownership, governments will lose out on license and registration fees and sales taxes on vehicle purchases. Eleven of the 25 largest cities reported annual registration and licensing revenues exceeding $25 million. Scott, Chicago’s former chief financial officer, also expects an eventual reorientation of entire local property tax systems as autonomous vehicles improve mobility and increase property values in neighborhoods currently deemed less desirable.

This leads to the larger issue of how motorists should pay for transportation, one that policymakers have long contended with. Many seem to think the solution is a vehicle miles traveled (VMT) fee as a replacement for traditional gas taxes. The idea isn’t new, but autonomous vehicles and the new technology that accompanies them would make VMT fees much easier to administer, says Paul Lewis of the Eno Center for Transportation. Eno proposes a national per-mile fee on autonomous vehicles as a baseline, with the ability to vary rates based on types of vehicles, number of passengers and other factors. Oregon operates a limited VMT program now, charging volunteer participants 1.5 cents per mile and crediting them for fuel taxes paid. The state Department of Transportation reports it’s considering testing new technology that would enable localities to assess their own fees on top of the state rate, which would likely require federal approval.

States and localities might recoup lost revenue by taxing or licensing autonomous vehicle services. Seattle collected $2.4 million in the last fiscal year in car-sharing fees paid by services such as car2go in lieu of charging subscribers for on-street parking. Electric vehicles will also require charging stations. But these sources alone probably won’t overcome sizable revenue reductions elsewhere. “We couldn’t find adequate sources of new revenue that would compensate for the losses,” says Kevin Desouza, a professor at Arizona State University who researches the issue.

In other ways, however, the introduction of autonomous vehicles should yield significant cost savings. Parking and traffic enforcement would require far fewer resources. If autonomous vehicles help to ease congestion, infrastructure maintenance and construction costs could go down in the long run. The parking lots and garages that currently take up huge portions of downtown land could be redeveloped into new revenue-generating residential or commercial buildings as the need for parking subsides.

“We’re going to start to rethink how we make use of our public facilities,” says Ken Husting of Los Angeles’ parking management division. One development project in the city’s downtown features a parking garage that can be altered to eventually accommodate retail and other uses. Some vehicles on the market today already employ technology enabling them to park in much tighter spaces. Unused street parking spaces, Husting says, could be converted into wider sidewalks, bike lanes or transit lanes.

One thing everyone agrees on is that cities shouldn’t wait to plan for autonomous vehicles. Desouza says American cities are well behind other parts of the world in this regard. A 2015 National League of Cities analysis of urban transportation planning documents found that only 6 percent of the plans considered the potential effects of driverless technology. It’s critical, Desouza says, that governments first engage citizens on what’s important to them. “The hits can be minimized,” he says, “but it really comes down to how the local governments are planning for it.”

While it’s far too early to know exactly how the technology will evolve, the consequences are certain to go far beyond any city’s bottom line. “It’s hard to think of an aspect of city government,” says the Aspen Institute’s Bradley, “that won’t eventually be touched and changed by autonomous vehicles.”

Review vehicle-related revenue data for each city.