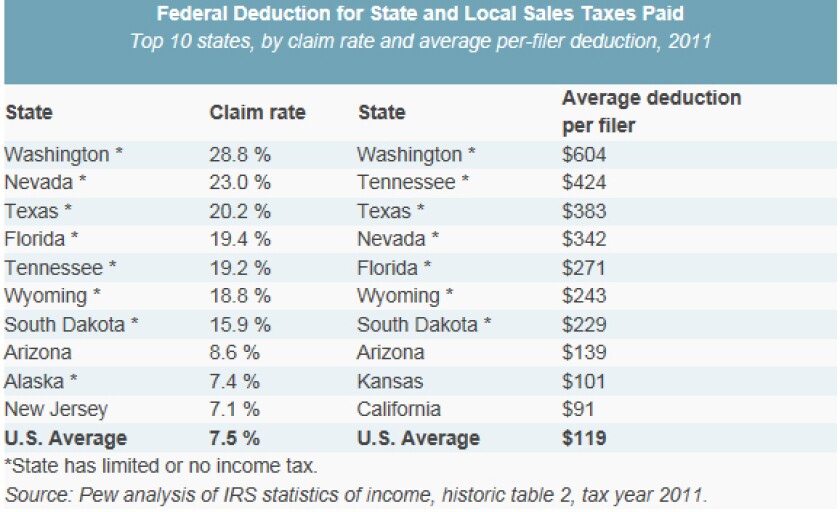

Currently Americans can deduct certain taxes paid to state and local governments (including taxes on real estate, property, and income or sales) from their federal tax returns. The deduction for state and local sales taxes is among 55 temporary federal tax provisions scheduled to expire at the end of 2013 and losing the exemption could have an adverse impact on states, according to an issue brief published by the Pew Charitable Trusts this month. In 2011, about 11 million filers claimed a total of $17 billion in state and local sales tax deductions.

Some 7.5 percent of filers nationwide claimed such a deduction; in the seven states that do not tax income, people were much more likely to claim a deduction for state and local taxes; the rate of those two claimed the exemption was at least double the national rate. Washington state had the highest activity with nearly 19 percent of claims including the sales tax deduction, averaging a little more than $600 per filer.

Eliminating this option for filers will likely reduce their refunds, translating into less disposable income to spend on state and local economies. Changes to these deductions could “have an indirect impact on revenues,” the brief says. If the federal tax exemption is not extended, state policy makers will likely have to make a decision about how to address the shortfall, said Anne Stauffer, director of Pew’s Fiscal Federalism Initiative.

“My sense is the response would be that policy makers have to make decisions on whether they are going to change their tax codes or fiscal policies based on what they think the impact will be,” she said.

Any hit to consumer’s wallets in a slowly recovering economy will make a dent in state sales tax collections. This year marked the expiration of the payroll tax cut, a break that affected nearly 155 million workers and put an additional $1,000 a year in the pocket of the typical worker earning $50,000. A survey in May 2013 by Liberty Street Economics found that most consumers (79 percent) planned to cover the loss in income by cutting spending. A small fraction (2 percent) planned to increase debt while the remainder planned to cut their savings contributions.

There still is a chance, however, that Congress will move to extend the deduction. Since its introduction as a temporary measure in 2004, the sales tax deduction has been extended three times. The last extension was in 2010. And it could take as long as a year for Congress to approve an extension retroactively. The fiscal cliff deal at the end of 2012, for example, included the retroactive extension of tax provisions that had expired in 2011.

“This is just one of many tax policies where federal and state tax codes are interconnected,” said Stauffer. “It’s important for federal and state policy makers, when they look at changes, to understand there will be state impacts and to understand that impact varies.”