Yes, Stumbo counters, but the state already owes the money. “You shouldn’t be scared of that fact,” he says. The key questions are: Is the market favorable? Is the plan sound? Will it bring stability to the fund? “The answer to all three of those,” he says emphatically, “is yes.”

For now, Kentucky won’t be borrowing the $3.3 billion. The state Senate voted in March to study the funding issue further. Meanwhile the problem is clear. Last year, the Kentucky Teachers’ Retirement System (KTRS) saw its unfunded pension liability swell by nearly $9 billion. Suddenly, the system appeared to have less than half the assets it needed to pay its retirees. Kentucky’s funding status stood at 46 percent -- a drop of 6 percentage points from 2013. It was the biggest single-year drop reported by the plan since the tech stock bubble burst in 2001.

This time, however, the culprit wasn’t a slide in the stock market -- it was accounting. Thanks to new pension accounting rules put forth by the Governmental Accounting Standards Board (GASB), Kentucky, along with a handful of other plans, has been forced to lower its discount rate -- that is, the rate of return on its investments that it uses to determine the value of its total pension liabilities. The higher the expected rate of return, the lower the amount of funding a government needs to pay into its pension plan. The opposite is true when the rate of return is lowered. For Kentucky, which had to bring its rate down by more than two points to 5.23 percent, the effect was to increase the total liability. With the lower rate for investment performance, the plan will need more money to pay its pension obligations.

In a Governing analysis of 80 pension plans that had comparable data available, about one-third adjusted their discount rate downward but just nine plans in four states lowered it by more than a half-percentage point. The results for most of those plans were dramatic changes in their total pension liabilities while their assets on hand either improved somewhat or stayed the same.

The discount rate rule, known as GASB 67, is just part of the story. Another piece of the new rule, GASB 68, will hit financial statements starting later this year. Under that new rule, governments that are members of a pension plan -- say, localities that pool their money with a state plan -- are required to report their share of that plan’s unfunded liability on their governmentwide balance sheet for the 2015 fiscal year, something most of those governments have never before had to do. Now most will be adding millions of dollars in liabilities, forcing lawmakers to acknowledge the role pension payments play in their government’s overall financial picture.

Volatility and uncertainty are likely as governments grapple with the fiscal adjustment to this latest round of GASB accounting rules. But in the long run, the new accounting standards will call attention to the need for governments to contribute regularly to pensions and to acknowledge the role that funding plays in mitigating ballooning liabilities. The rules may also force a decision for some governments who will either be pushed into meeting their funding obligations or finding other strategies to keep plans solvent.

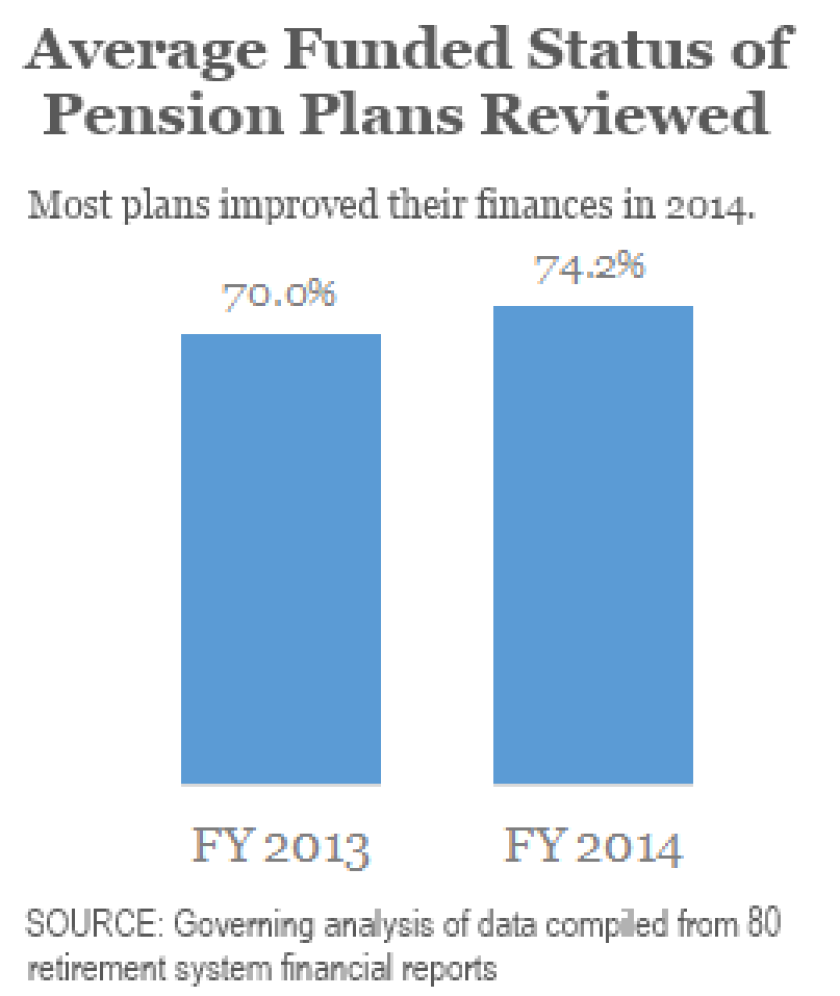

In some ways, the change to pension accounting couldn’t have come at a more convenient time. The new assumptions also require plans to report current market-value assets instead of asset values that “smooth in” -- and tend to hide -- investment gains and losses over time. As late as 2013, actuaries were still smoothing in the asset losses from 2008 and 2009. Many plans were reporting a lower actuarial value of their assets than was actually in the fund. Now, the market assets reported reflect the big gains in the stock market over the prior year. Plans in the Governing sample had an average annual increase in assets of an impressive 14.6 percent. All but eight plans recorded increases. The average funded status of plans jumped from 70 percent in 2013 to more than 74 percent in 2014.

Still, the discount rate treatment remains a key dividing force in the pension accounting rule, GASB 67. This rule requires plan actuaries to assess whether the pension fund will run out of money by considering factors such as past contribution patterns and expected future contributions from state and local governments, as well as expected contributions from employees, investment performance, and projected overall pension payouts. If there is a depletion date, the actuary must use a market rate of return (these days around 3 or 4 percent) to calculate the value of what the plan still owes after the fund runs out of money. The result is a blended discount rate that skews lower for plans that are low on assets.

Plans like KTRS that have not had reliable government contributions must use a more conservative measurement. Because of the rule, Kentucky’s total payouts to KTRS retirees went from a projected $28.8 billion in 2013 to its current projection of $39.7 billion. Although the Kentucky bond proposal was not a direct result of the accounting changes, the rule adds a strain to a system that is already under pressure, says KTRS Executive Secretary Gary Harbin. “It puts that out there that if the cash flow is not there, it gets to a point where it starts impacting investments,” he says. “We feel we’re at that point.”

Most plans, however, say they won’t have a depletion date. Therefore, their actuaries can use the long-term expected rate of return (typically between 7 and 8 percent for most pension plans) to calculate the total pension liability. The Teachers’ Retirement System of Louisiana, a plan similar in size to KTRS, has a solid stream of government contributions and reported a much smaller total liability increase than its Kentucky counterpart.

Kentucky’s teacher retirement plan isn’t the only pension plan in trouble in the state. The Kentucky Employees Retirement System (KERS) has been in a free-fall for years. Its funded status is 25 percent, the lowest ratio of any system reviewed. But unlike the teachers plan, KERS avoided using a lower discount rate, which would have sunk its funded status even further. That’s because in 2013, the Kentucky Legislature created a funding plan and has set aside its full contribution to the system for 2015 and 2016, something it has not done in more than a decade. Funding plans in other states have potentially saved other shaky pension systems from raising their total pension liability. In 2014, California enacted legislation that required increased contributions to teacher pensions in an effort to shore up funding for that system.

Of course, the funding plan has to be followed. New Jersey enacted pension reform in 2011 that called for the state to ramp up payments into its pension funds over the course of seven years. But New Jersey has failed to follow through on those payments. A New Jersey Superior Court judge ruled in February that Gov. Chris Christie violated state law when he twice declined to make the full payment into the state’s pension system. Now, Christie is pushing controversial pension legislation that cuts the benefits current employees can earn in the future. The new accounting rules lend an air of urgency to Christie’s plan as the funded status for two state plans plummeted this year. It is now 28 percent for New Jersey’s state employees fund and 34 percent for the state’s teachers plan. “This new reporting system,” Christopher Santarelli, spokesman for the state department of the treasury, said, “only underscores the urgent need for additional, aggressive reform of a pension and health benefits system that if fully funded would eat up 20 percent of New Jersey’s budget.”

This same fate could meet other plans that don’t keep up their pension funding. “Keep in mind, it is a ‘trust but verify’ condition,” says GASB Chairman David Vaudt. “There will be fluctuations in liabilities if governments don’t meet their funding commitments.”

The impact of GASB’s proposed accounting practices is not far off. GASB 68, the rule that requires governments to report their share of a pension plan’s unfunded liability on their governmentwide balance sheet, calls for the new math to appear in a government’s 2015 Comprehensive Annual Financial Report.

The prospect of adding millions in debt on the balance sheet isn’t exactly inviting, but it’s something larger governments are braced for. But smaller governments and municipalities, particularly school districts that may see outsized liabilities on their financial sheets, could be blindsided. For most local governments, managing their pension responsibilities has simply meant paying the bill that the pension plan sends them. “The responsibility of paying benefits has for so long been not transparent, nobody feels like they have the responsibility,” says Sheila Weinberg, the founder and CEO of Truth in Accounting, a national nonprofit that advocates fiscal transparency. “There has been some education, but I think it still will be a shock to the smaller governments.”

The new liability is a volatile one. It could swing up or down from year to year depending on the pension plan’s market performance or if governments take a break in funding. Still, many agree that requiring governments to report their own liabilities is a common-sense move. Adjustment to it will take years. But ultimately, governments will have a truer picture of their fiscal health, and that will force many to take ownership of the issue.

Whether the tide goes toward figuring out a way to steadily fund pensions, as some in Kentucky would like, or negotiating benefit reductions and a change in plan structure, as is proposed in New Jersey, remains to be seen.

“This liability has already existed,” says Ted Williamson, a partner in RubinBrown’s Public Sector Services Group. “It’s just that up until now, this hasn’t been reflected. This change makes it top-of-mind for lawmakers. They need to think about a long-term strategy for their pension plans.”

View financial data for the 80 state and local retirement systems reviewed.