Fewer than half of states have the funds they need to weather the economic downturn, and nearly one-third would likely face significant fiscal stress, according to a report released today by Moody’s Analytics.

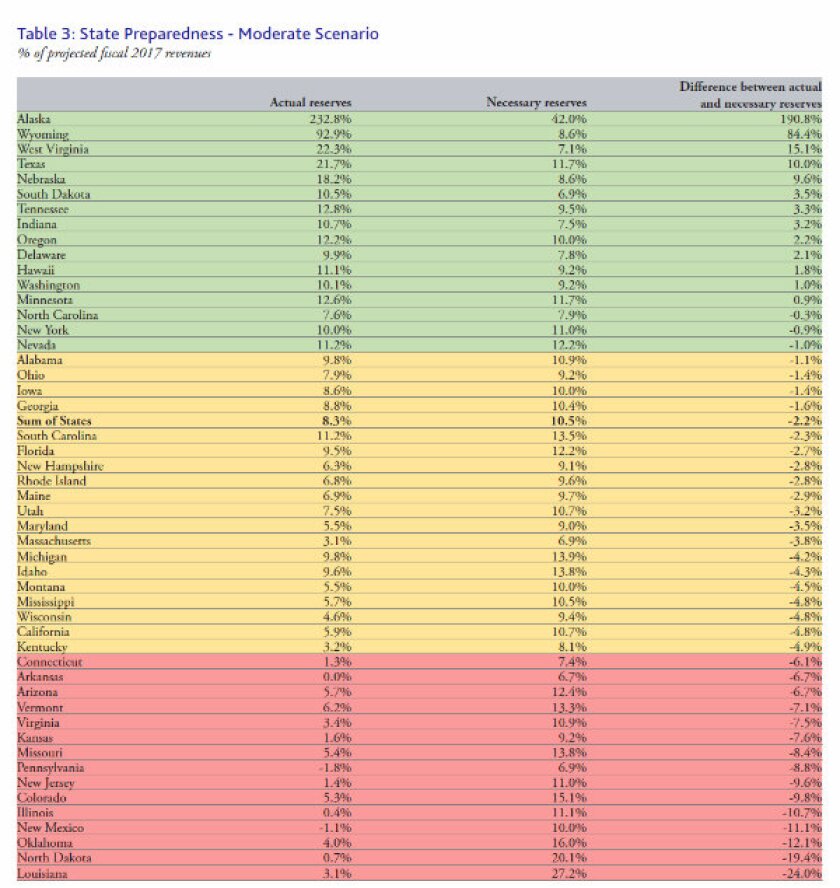

The report conducted the first-ever stress test on all 50 state budgets to assess their ability to absorb a fiscal shock. It found that 16 states have enough in reserves to get through the next recession somewhat comfortably. Another 19 states have some or most of the funds they would need, which means they would likely have to raise revenue and/or cut spending, as well as tap reserves, to balance their budgets during a downturn. And 15 states are so “substantially unprepared” for the next downturn, they would face major “economic repercussions.”

The idea of stress testing state budgets, which was borrowed from the U.S. Federal Reserve, essentially throws different economic scenarios at a state budget to see how revenues would be impacted. While the idea is popular with economists and ratings firms, only a few states actually conduct their own stress tests.

In its analysis, Moody’s Analytics ran two different scenarios: a moderate recession and a more severe downturn that mimics the losses experienced during the Great Recession. The models took into each state’s tax structure, revenue volatility, expected spending on Medicaid, and existing reserves and fund balances, among other things.

Having the proper cushion allows lawmakers to keep making policy when times are tough, rather than simply just reacting, says Moody’s senior economist Dan White, the report’s author. “If you have the reserves put away and don’t have to worry about making ends meet," he says, "that gives you more time to focus resources on things that are really plaguing you -- like the cost of Medicaid.”

White’s modeling gives states at least one or two years before the next economic downturn. That means places like California, Kentucky and Wisconsin, which have about half of the savings Moody’s estimates they need, potentially have time to improve their position. But for the states with slim-to-no savings set aside (such as Connecticut, New Jersey and Pennsylvania), White says it’s likely too late to make the needed adjustment before the next recession.

Many of the states that fall into the unprepared category are there because they haven’t addressed their structural budget burdens. Pennsylvania, for instance, has consistently struggled with balancing its budget over the last decade. Part of the reason is that its Medicaid spending is gobbling up nearly 40 percent of the budget and giving it less flexibility than any other state. “They just really haven’t had the breathing room necessary to set aside any amount for reserves,” says White.

While many state budgets were seemingly blindsided in 2008 by free-falling revenues, White says there was at least one person in every state who should have known the recession was coming: the state Medicaid director. That’s because enrollment jumped significantly beginning in the first half of 2008, nearly a year before revenues began taking a nose dive.

Medicaid enrollment in states that have expanded their programs under the Affordable Care Act is still increasing for noneconomic reasons. But White expects that to level off before the next downturn.

Where Does Your State Rank?

The chart below ranks states based on how well they performed under the "moderate scenario" (click here to enlarge chart):

Sources: Moody's Analytics, National Association of State Budget Officers