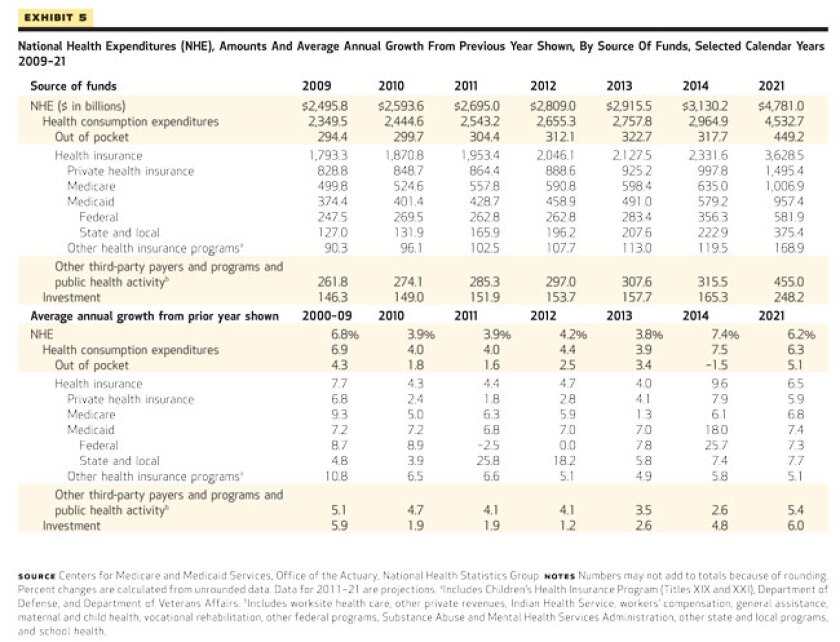

CMS estimated that state and local Medicaid expenditures jumped 25.8 percent in 2011 (to $165.9 billion) and would expand again by 18.2 percent in 2012 (to $196.2 billion) -- by far the largest percentage increase for any individual payer over those two years. The dramatic incline is primarily the result of the expiring federal enhanced match from the American Recovery and Reinvestment Act (ARRA) and sustained enrollment increases because of the economic downturn, CMS officials said.

Long-term, state and local Medicaid spending is projected to settle into a consistent growth rate between 7.4 and 7.7 percent from 2014 -- when the expansions and reforms under the Affordable Care Act (ACA) take full effect -- to 2021, reaching $375.4 billion in 2021. Those percentages outpace the expected increases in overall national health spending, which fluctuate between 6.2 percent and 7.4 percent from 2014 to 2021.

Combined with federal matching, Medicaid spending would reach $579.2 billion in 2014 (up 18 percent from 2013) and increase to $957.4 billion by 2021. The overall program would experience the largest annual growth increases of any payer over the next 10 years under the CMS projections.

According to the National Association of State Budget Officers’ 2012 Fiscal Survey of the States, also released Tuesday, states have taken substantial steps in the last year to control Medicaid costs. For example: 31 states enhanced their program integrity efforts, 30 states reduced provider payments and 22 attempted to cut prescription drug costs through various means. Further steps are likely in the coming years: 20 states have proposed expanding managed care programs for FY 2013; 15 are considering further provider payment reductions, and 18 have proposed limiting benefits for enrollees.

When the ACA’s Medicaid expansion takes effect in 2014, the program’s enrollment is expected to swell from 56.4 million in 2013 to 76 million. The law increases Medicaid eligibility to 133 percent of the federal poverty level, and analysts anticipate those currently eligible but not enrolled would also join the program to comply with the ACA’s individual mandate. CMS estimates enrollment reaching 85 million by 2021.

The federal government would shoulder the majority of the spending for newly eligible Medicaid enrollees, who are expected to account for most of the increased enrollment. Federal Medicaid spending would increase by 25.7 percent in 2014 (compared to 7.4 percent for state and local) to $356.3 billion and reach $581.9 billion in 2021, under the CMS model. The ACA mandates the federal government cover 100 percent of the costs for newly eligible enrollees in 2014, a match that declines to 90 percent by 2020.

As a whole, including private insurance and personal spending, national health expenditures are projected to increase by an average rate of 5.7 percent from 2011 to 2021, reaching nearly $4.8 trillion in 2021 (19.6 percent of the U.S. gross domestic product, up from 17.9 percent in 2011). National health spending is expected to grow 3.9 percent in 2011, 4.2 percent in 2012 and 3.8 percent in 2013 -- in line with a historic low of 3.8 percent in 2009, a result of the Great Recession and the modest recovery since, CMS officials explained. When the ACA’s reforms take full effect in 2014, estimated growth jumps to 7.4 percent before declining to 6.2 percent in 2021.

The CMS numbers are considered the authoritative long-term projections for national health spending. Officials from the CMS Office of the Actuary, who authored the report, included several caveats: most importantly, the estimates assume that the ACA will survive its challenge before the U.S. Supreme Court and remain law. CMS did not produce projections for a scenario in which the law is reversed or repealed.

As a share of national health spending, state and local-sponsored expenditures are expected to increase by 1 percent, from 17 to 18 percent, between 2011 and 2021. Federal-sponsored spending would rise from 29 to 31 percent, meaning government expenditures would account for nearly 50 percent of the overall health care industry within the next 10 years. The shares for household (27 to 26 percent) and business (20 to 18 percent) spending are projected to decline.

By payer, Medicaid’s share of national health spending would swell the most: from 16 percent in 2011 to 20 percent in 2021, primarily a result of the ACA expansion. Medicare would remain steady at 21 percent, while private health insurance would drop from 32 to 31 percent; federal spending would also comprise a growing percentage of the private market through the ACA’s tax subsidies. Personal out-of-pocket spending would decline from 11 to 9 percent between 2011 and 2021.

The number of uninsured Americans is expected to fall from 48.6 million in 2013 to 27.8 percent in 2014 after the ACA reforms take full effect, dropping further to 23.1 million by 2021. About 12.3 million people are estimated to join the state health insurance exchanges in 2014, increasing to 23.1 million by 2021.

The table below -- courtesy of Health Affairs, which published the full report -- details the CMS projections.