The Commonwealth Fund, a private foundation, pooled individual reports from the states that are operating their own exchanges. The other 36 states asked the federal government to run their online marketplaces, a key part of President Barack Obama’s health care overhaul. Their data is released by the federal Department of Health and Human Services.

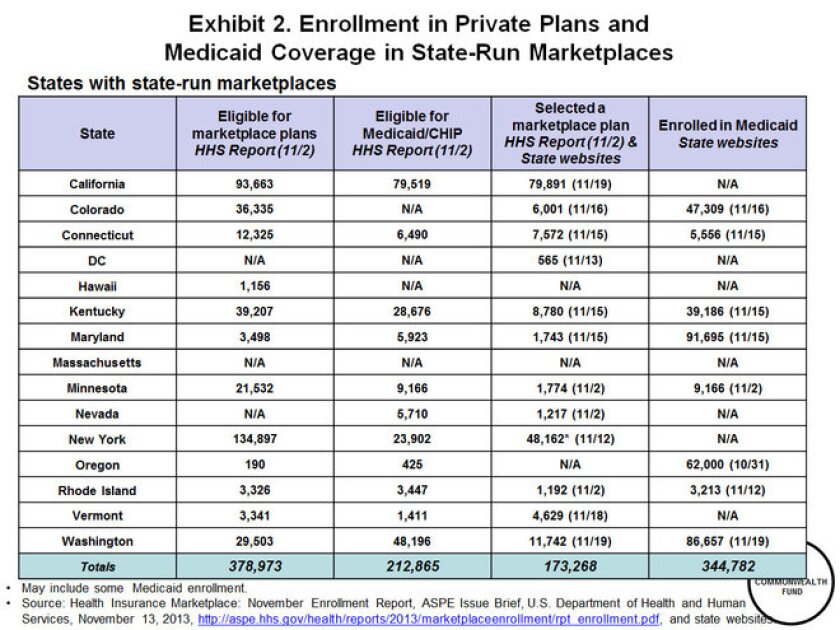

The number of people who have selected plans—but not necessarily paid for them yet—is 173,268 through Nov. 19, though some of the figures from individual states cited in the report were no more recent than those included in an earlier HHS report spanning only the first month of enrollment. (See chart below.)

That figure doesn’t include fresh data from the 36 states operating in the federal exchange, which earlier this month reported a paltry 26,794 people selected a plan in the first month of operation. The earlier Health and Human Services report concluded about 106,000 signed up for private coverage across every marketplace, but about three-quarters of those came from the state-run exchanges. A new report from Health and Human Services is expected in the coming weeks. Combining the 26,000 already reported for the federal exchange and the latest figures from state exchanges brings the total number of people who have selected plans to at least 200,000, Commonwealth finds.

The state-run exchanges that provided the most recent data showed the biggest gains. In California, the number grew to about 80,000, up from about 35,000 in the HHS report. In New York, the next highest leader in either the Commonwealth or HHS reports, about 48,000 have selected plans, up from 16,000 at the end of first-month enrollment. In Washington State, sign-ups grew from about 7,000 to 12,000.

The online exchanges are designed to serve people who aren’t a part of the 85 percent of Americans who get health coverage through their employers. The Congressional Budget Office has estimated about 7 million people will get private coverage through the exchanges, many of them with subsidies to offset the costs of premiums. Commonwealth's figures put enrollment at about 3 percent of CBO estimates, meaning there's a long way to go to hit those marks.

The exchanges were also designed to allow qualifying applicants to sign up for Medicaid, the insurance program for low-income and disabled people, but they’re not yet able to complete the enrollment process online. That hasn't stymied Medicaid enrollment, at least in states that are expanding the program, many of whom are also running their own health insurance exchanges. Commonwealth found 344,000 people have signed up for Medicaid through state exchanges or paper applications. Every state operating its own exchange is expanding the program to childless adults earning up to 138 percent of the federal poverty level.

HHS officials warned when releasing their totals earlier this month that individual states might report something different, and Commonwealth researchers acknowledged “there’s fluidity in the numbers,” but they argue the report shows people are moving beyond the browsing stage.

“I do think it means people have moved beyond applying or determining eligibility,” said Sara Collins, vice president for health coverage and access. "The demand is quite high, and I think we’ll see a surge after the holiday and early December with people knowing they have a deadline to get coverage by January."

It’s not certain how many of the people who selected a plan have paid initial premiums for coverage that starts Jan. 1. Read the Commonwealth report here.